Security deposit requirements can be a big barrier to occupancy. Unfortunately, many renters can’t afford to pay rising rents without a significant burden.

Affordability continues to be top of mind for renters. Over 69% feel that it’s now difficult to find affordable housing in their community.

As 2022 continues to progress, it’s undeniable that the landscape of renting across the United States is changing—rent costs are high, inventory is low, and becoming more consolidated— and the real estate industry is recognizing that security deposit insurance can help support a new rental future in 2023 and beyond.

What is security deposit insurance?

Security deposit insurance replaces a renter’s cash security fee with a smart, affordable insurance policy.

This renter pays a small monthly fee or makes a nominal one-time payment, securing the unit for its owner/operator, at no cost to the owner/operator.

Owners and operators are still able to receive asset protection of multiples of monthly rent—covering things like lost rent, unpaid fees, and physical damage beyond normal wear and tear.

Why is security deposit insurance a desirable program to offer at your communities today? First, let’s look at where the market is now to understand why security deposit insurance is a no-brainer in today’s economy.

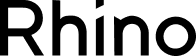

Where the rental market is now

With rising costs, owners and operators may have to choose between two sub-optimal things: lowering their deposits, leaving them open to deficits when they turn apartments over, OR raising their deposits and putting additional pressure on renters on top of rising rents. Owners and operators need money in their hands now, not at the end of leases or post potential lengthy legal action over rent default and eviction.

Meanwhile, many owners and operators are struggling with low employee retention—74% of property professionals said staffing and recruitment was their top challenge today—and losing time to unsustainable processes like dealing with security deposit claims and payments.

Why security deposit insurance can change the future for owners/operators

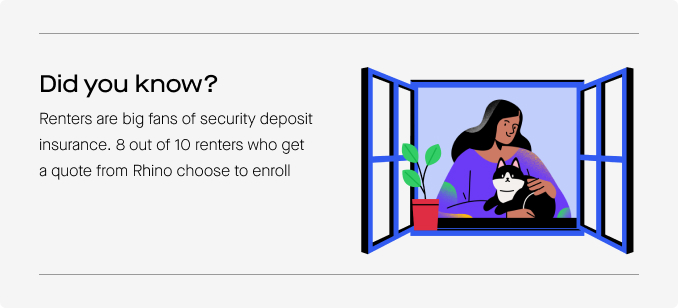

The future of security deposits is here and it’s not cash. Based on our data, 80% of renters who are offered security deposit insurance as an option opt-in. Here’s why security deposit insurance is an obvious choice for modern owners/operators and for renters.

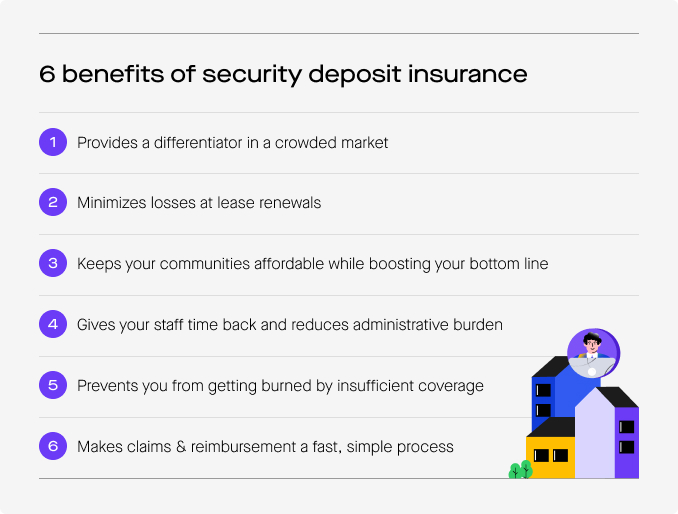

1. Provides a differentiator in a crowded market

The rental market is more competitive and crowded than ever. Renters are looking for renter-friendly operators, unique amenities, and ways to save.

What does the building or home down the street from you offer? It’s about much more than just rental size now.

Security deposit insurance reduces move-in costs for renters by almost 90%, so they can spend their savings on expenses like rent and groceries—something sure to catch their eye.

It also allows you to list rentals as “Deposit-free,” providing a marketing advantage over the competition on online listings.

2. Minimizes the number of residents you lose at renewal

Keeping a good renter in your building minimizes costs and headaches—especially since finding a new renter can cost between $100 and $2,500.

A strong retention tool, renters can get their cash back either as a rent credit or refund if they choose to opt-in to security deposit insurance at renewal, depending on your jurisdiction. A small monthly fee or nominal one-time payment is then put in its place.

Renters are excited to not only access funds that were previously in escrow, but they are not on the hook for offering up another lump sum to cover a security deposit increase.

Meanwhile, you’ll have the coverage you need for the next leasing period, at no cost to you. A win-win at a time in the rental cycle when renters have the most leverage.

3. Keeps your communities affordable while boosting your bottom line

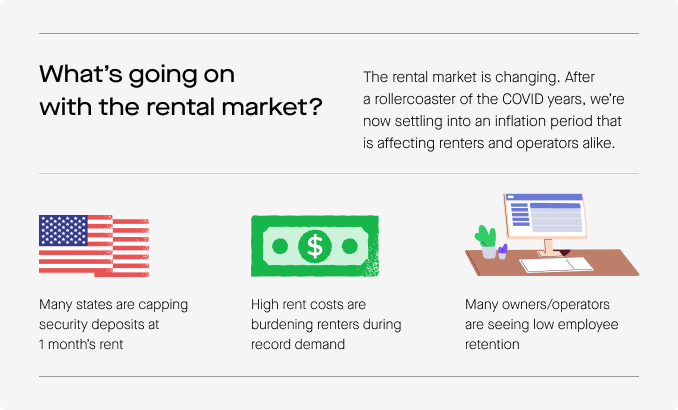

Security deposits are a barrier to a more affordable renting future. According to the Federal Reserve, over 50% of Americans can’t afford an unexpected $400 expense.

So it’s easy to see why having a month or two of rent on hand is an unfair standard to maintain. That money could be better used by renters to pay expenses like their rent and medical bills.

But where does this leave you? Without a security deposit, your bottom line is exposed.

Offering renters security deposit insurance gives renters the wiggle room they need while boosting your bottom line.

With more protection and less financial burden than cash, you’re able to ensure you can maintain your property and renter relationships—without pressuring renters.

4. Gives your staff time back and reduces administrative burden

The pandemic has put many owners and operators at the brink of exhaustion. In 2021, the average community manager tenure was 19.2 months. Increased employee turnover can affect your reputation in the industry and within your community. Streamlining and eliminating workflows can greatly relieve employees who are feeling the burn.

You know all too well that the amount of work spent processing security deposits is not equal to the benefit you get from them. The archaic process can include multiple programs, a slew of emails, and dozens of hours dealing with claims. Security deposit insurance reduces the amount of time your team is spending dealing with cash, escrow, and paperwork. Your team benefits from a streamlined process, reduced frustration, and considerable time back—meanwhile, you benefit from extra protection.

5. Prevents you from getting burned by insufficient coverage

In some regions in the US, like New York, Massachusetts, and Washington DC, owner/operators can only collect one month’s deposit. In some regions, you can’t collect any. This leaves many owners/operators without protection for unpaid rent, damages, and other unpaid fees. The risk remains for your business, no matter how well-meaning your renters are. Security deposit insurance is a no-cost way for owners/operators to get more protection for your business - covering unpaid costs and fees and allowing you to be promptly made whole mid-lease when excessive damages occur – instead of having to pursue, often lengthy and time-consuming, legal actions. Interested in reading examples of how security deposit insurance can eliminate bad debt? Read here.

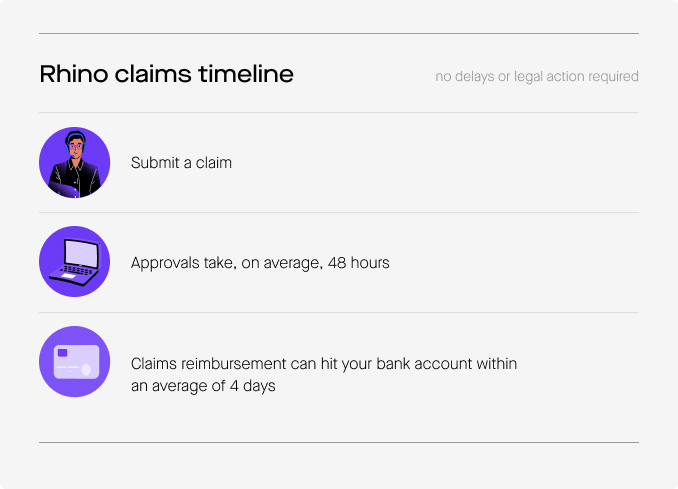

6. Makes claims and reimbursement a fast and simple process

Security deposits collect dust in the bank. Meanwhile, you cannot access the funds you need to cover damages or unpaid rent until the end of a leasing period or legal proceeding. This can significantly affect your bottom line while you wait for the money you are owed. Security deposit insurance is a proven way of getting money into your hands when you really need access to it.

If a renter has caused excessive damage, damages the property during move-out, or rent is at least 10 days late, property owners can file a claim on their renters’ policies.

Submitting a claim may be as simple as uploading a copy of the lease and a copy of your ledger to prove that rent wasn’t paid that month.

At Rhino, our in-house claims team works around the clock to review, process, and issue reimbursements based on losses accrued and approved. Claim reviews take, on average, 48 hours. If the claim is approved, payment can hit your bank account within an average of 4 days. During this process, we work directly with your renters to explain the claim and recover the paid claims amount from them, leaving you more time to handle other aspects of your business.

To recap, security deposit insurance replaces a renter’s cash security deposit with a smart, affordable insurance policy. This policy is paid for by the renter with a small monthly fee or a nominal, one-time payment, securing the unit for the owner/operator, at no cost to the owner/operator.

Owners/operators are still able to receive asset protection of multiples of monthly rent—covering things like lost rent, unpaid fees, and physical damage beyond normal wear and tear.

Why Rhino?

Rhino’s security deposit insurance provides multifamily, single-family, and student housing owners/operators with a convenient way to increase coverage up to 6x more than monthly rent while lowering move-in costs for renters—all at no cost to you.

Renters can enroll with Rhino at the beginning of their lease, at renewal, or even mid-lease—replacing their security deposit requirement either with a low monthly premium or a small upfront sum to insure you against excessive damages or unpaid fees, such as unpaid rent.

Renters save over 90% on average in upfront move-in costs when they enroll with Rhino, and 80% of renters who get a quote from Rhino choose to enroll—easing their financial burden while bolstering your asset protection.

Once a renter enrolls with Rhino, our streamlined, digital Rhino platform offers a transparent view of the entire renter journey.

Invitations to the platform can be auto-generated, automatically sent, and recorded, minimizing your reliance on emails. With integrations into many programs you likely already use (Yardi Voyager, PropertyWare, etc.), you can access all your asset performance and data all in one place.

Have a claim that needs filing? You can submit directly within the platform at any point during the lease and, if approved, see the money in your account within an average of 4 days.

Interested in learning more about Rhino’s security deposit insurance? Request a free demo here.

*Pricing will vary by individual renter. Actual rates determined based on the specific information provided to Rhino. Monthly payment plans may not be available to all renters.

Rhino New York LLC (Rhino Insurance Agency in California) (Rhino) is a licensed insurance agency, acting as a general agent for various insurance carriers. Coverage is subject to actual policy terms, conditions and exclusions and is currently not available in HI, MT, ND or WY. Coverage is subject to underwriting approval and may not be available to all persons, even if offered in your state. This post is not and should not be construed as legal or other professional advice. It is intended for general informational purposes only. Rhino makes no representations regarding the information contained herein and expressly disclaims all liability with respect to such information.